Foundry Market Getting Bigger Boost From China

SAN FRANCISCO — China-based fabless IC firms are expected to account for 19% of the global total of pure-play foundry sales in 2018, up from about 9% in 2016 and about 13% last year, according to market research firm IC Insights.

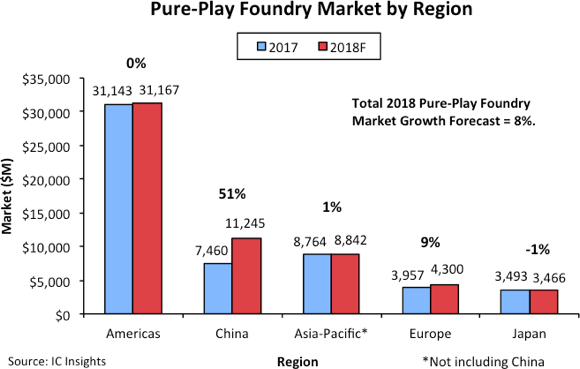

Overall, IC Insights forecasts that the pure-play foundry market will be worth about $59 billion this year, up 8% compared with 2017. China is forecast to be responsible for 90% of the $4.2 billion increase in the total pure-play foundry market this year, the firm said.

With the rise of fabless firms in China in recent years, the country's share of the global pure-play foundry market has been growing rapidly. But in 2018, China's pure-play foundry business is projected to grow at the fastest rate yet, rising by 51% to reach $11.25 billion — more than any other market outside of North America. The 51% growth rate of sales to China is more than eight times the forecast 8% rise for the market as a whole.

TSMC — by far the market leader in pure-play foundry — is expected to see its sales to China increase by 79% to $1.8 billion this year to reach $6.7 billion, IC Insights said. The firm projects that China will account for essentially all of TSMC's sales increase this year. TSMC's sales to China increased by 44% last year, the firm said.

IC Insights credits much of TSMC's sales surge into China in recent years to increased demand for custom devices going into the cryptocurrency market. Many of the large cryptocurrency fabless design firms are based in China and most of them have been turning to TSMC to produce their advanced chips for these applications, IC Insights said.

IC Insights noted that TSMC has indicated it expects a slowdown in its cryptocurrency business in the second half of this year. The firm added that TSMC realized from the beginning that the cryptocurrency market would be volatile and did not adjust its capacity plans based on the strength of the market or incorporate cryptocurrency business assumptions into its forecasts for future long-term growth.

— Dylan McGrath is the editor-in-chief of EE Times.